tax on venmo payments

1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099-K for them reporting. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and services.

.jpeg)

New P2p Tax Laws Of 2022 In The Us Simplified Compareremit

Thats why Venmo is mandated to file and issue taxpayers with Form 1099-K Payment Card and Third Party Network Transactions.

. It is going to be up to the taxpayer if they receive a 1099 in any form for a nontaxable event such as splitting rent among roommates splitting. Venmo payments are only taxable if theyre. Will you get taxed on personal Venmo payments.

For most states the threshold is 20000 USD in gross payment volume from sales of goods or services in a single year AND 200 payments for goods and services in the same year. If you go out to dinner with a friend and you Venmo them your part of the bill youre not going to be taxed. To help ensure compliance with new federal regulations payments received for sales of goods and services in excess of federal or state reporting thresholds will be placed on hold until your tax information.

IRS rules state that if an organization pays a gig worker via a third-party processor such as Venmo the payer does not have to issue a 1099-MISC for that pay. Earning Money Through PayPal or Venmo. Any income earned via peer-to-peer payment.

The transactions you received on Venmo may be taxable. Block Tax Services can answer all your questions about tax compliance for payments from services like Venmo and Zelle. The payment platform must take care.

For residents of Massachusetts Maryland Vermont and Virginia the threshold is 600 USD irrespective of the number of transactions. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes. If youre a business there is no difference between the payments received on Venmo and any other.

But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. The annual gift-tax exclusion for 2021 is 15000 per donor per recipient meaning you dont need to pay taxes on a gift given that equaled 15000 or less. Article continues below advertisement.

So if your business received 600 or more on Venmo PayPal or another P2P app those payments will be reported to the IRS and youll be held accountable for paying taxes on them. Venmo and other payment services will have to report 600 or more in payments to the IRS and provide you with a 1099-K for the year 2022. If you use PayPal Venmo or other P2P platforms for business save time with effortless expense tracking year-round with QuickBooks Self-Employed which can easily import expenses into TurboTax Self-Employed during tax time.

Tagged as goods and services Made to a separate Venmo business account more on this later The new tax rule has left Venmo users with a lot of questions. You May Owe the IRS Money Next Year If you make more than 600 through digital payment apps in 2022 it will be reported to the IRS. But users were largely mistaken to believe the change applied to them.

The catch is that you cant deduct losses on such sales so if you paid 300 for the LP and then sold it for 5 you cant write off the 295 you forfeited. Call our office at 410 727-6006 or fill out our contact form for a free consultation regarding this or any other tax questions. No your personal Venmo transactions wont get taxed even with the new law about 1099-K forms.

The American Rescue Plan Act lowered the threshold for reporting P2P network transactions to 600. Under the American Rescue Plan starting this year payment platforms like Venmo and Zelle are now required to report transactions for goods or services worth over 600 per year to the IRS. Its a dramatic increase in oversight from years past when annual payments had to exceed 20000 to warrant gig workers getting slapped with a 1099-K the tax form for transactions on payment.

The IRS is not requiring individuals to report or pay taxes on individual Venmo. The difference now is that PayPal. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Venmo On Twitter Got Questions About Venmo Amp Taxes Let S Break Down Which Payments Are And Aren T Affected By The 2022 Tax Changes For More Info Head To Https T Co Pwh2p15gl2 Https T Co Behbpcnsxj Twitter

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

:max_bytes(150000):strip_icc()/Venmo-ItsBusinessModelandCompetition2-7a04c392fba04909b3d5dd560a9782e3.png)

Venmo Its Business Model And Competition

Here S Who Will Have To Pay Taxes On Venmo Paypal Transactions Youtube

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

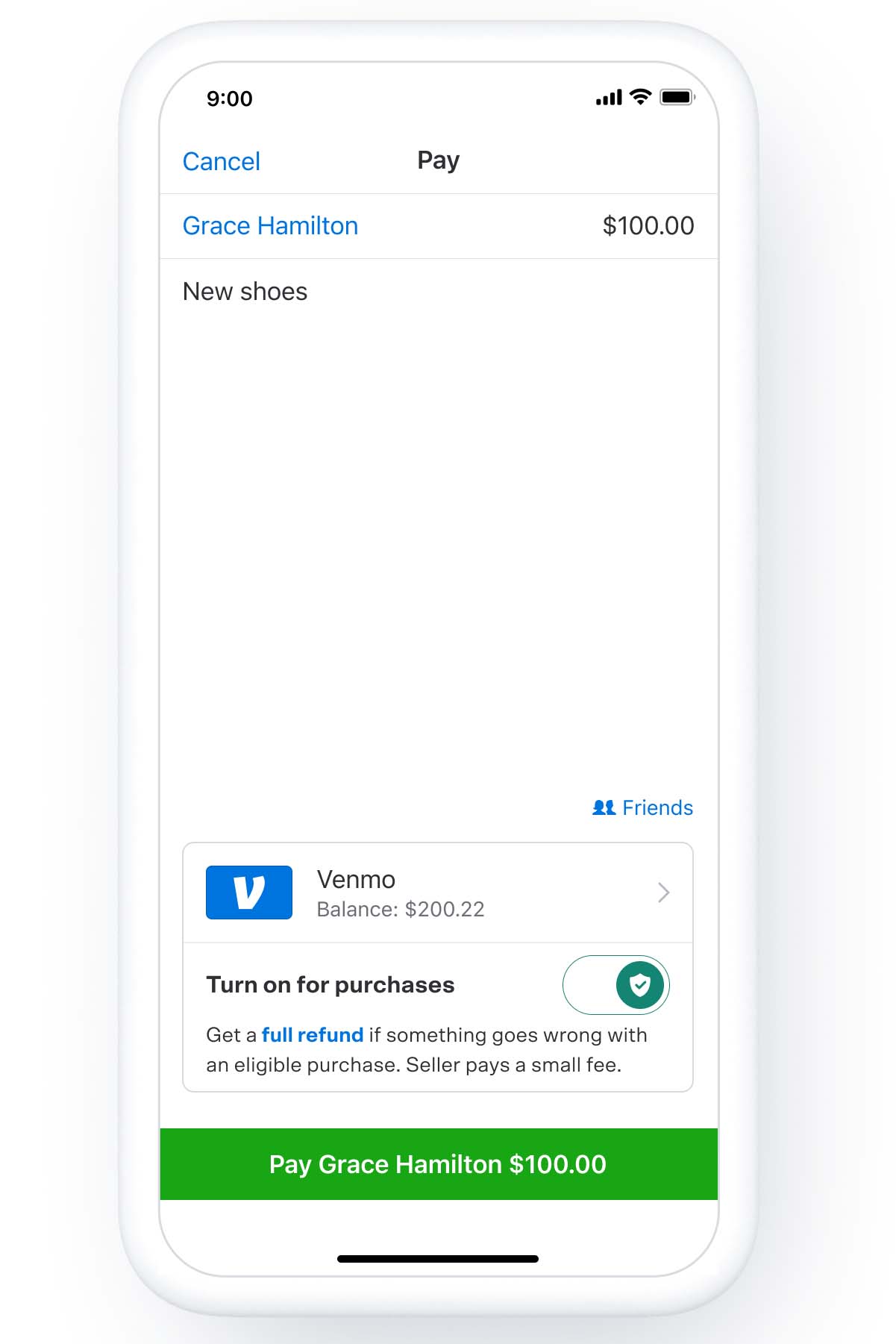

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

If You Use Venmo Paypal Or Cashapp You Need To Watch This Youtube

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes R Tax

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others Gobankingrates

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor